Product Description

This product pays a guaranteed coupon of 15% (30% p.a.). As long as no barrier event has occurred during the lifetime of the product, the investor will receive the notional (100%).

If a barrier event has occurred and all underlyings trade above their strike levels at maturity, the investor will receive the notional (100%).

If a barrier event has occurred and the price of any underlying is below its strike level at maturity, the investor will realize the performance of the underlying with the lowest performance, as determined and calculated by the Calculation Agent.

The guaranteed coupon will be paid in any case, no matter if a barrier event has occurred or not.

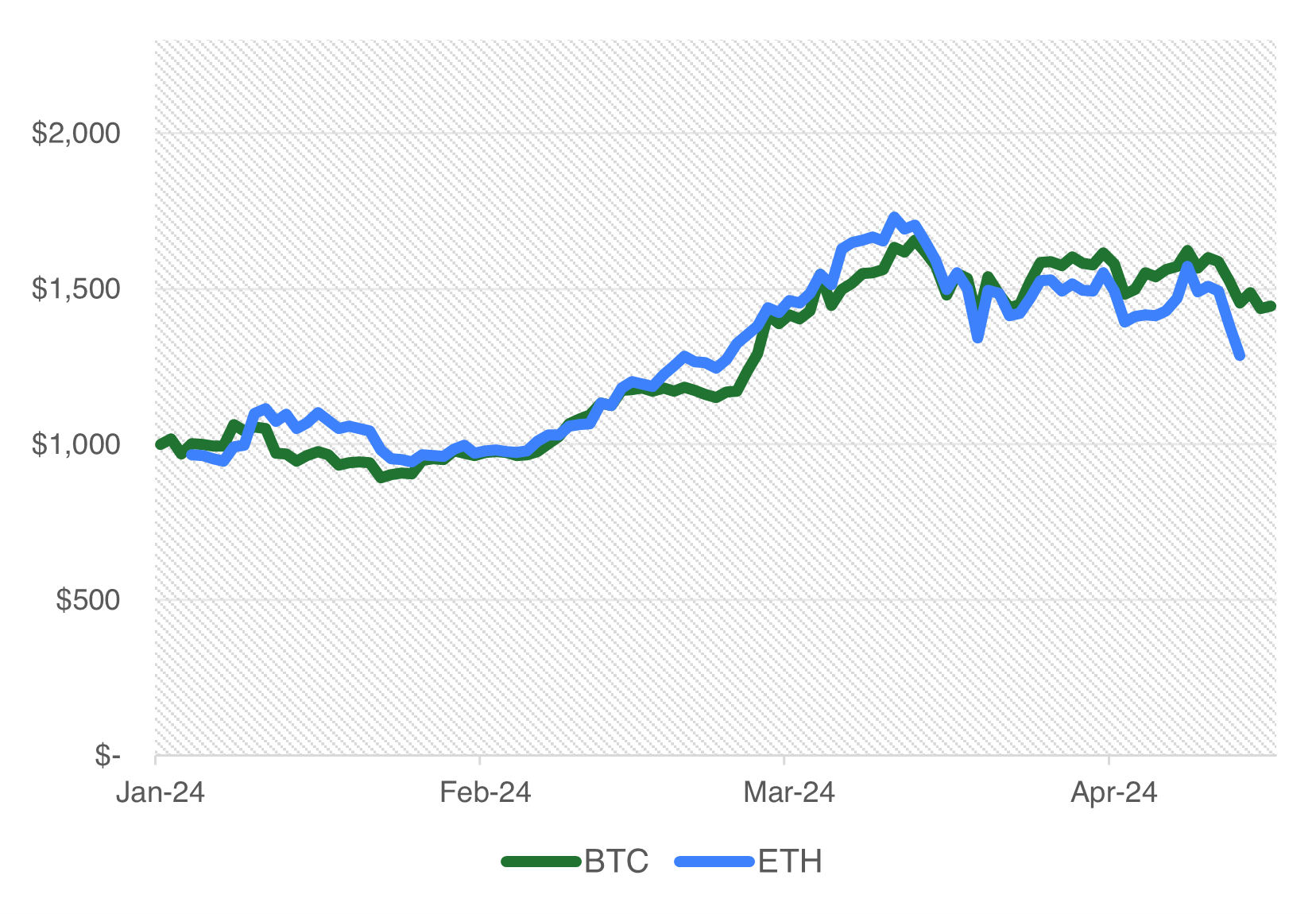

Historical Performance

Product Details

| Issuer | Helveteq AG |

| SSPA Designation | BRC (1230) |

| Base Currency | USD |

| VALOR | 134329008 |

| ISIN | CH1343290081 |

| Subscription Period | 17.04. – 02.05.2024 |

| Initial Fixing | 03.05.2024 |

| Final Fixing | 08.11.2024 |

| Repayment Date | 15.11.2024 |

| Coupon | 30.00% p.a. |

| Barrier | 70% American |

| Strike Levels | BTC: 59’177.00 ETH: 2’968.620 |

| Barrier Levels | BTC: 41’423.90 ETH: 2’078.034 |

| Settlement | Cash |

| Nominal Value | 1’000.00 |

| Issue Size | 10’000’000.00 |

Service Providers

| Custodian | Bank Frick |

| Administrator | Bank Frick |

| Security Agent | Adexas Rechtsanwälte AG |