Product Description

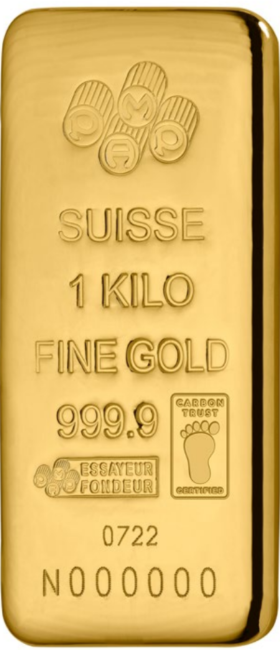

Swiss Green Gold ETP (Exchange Traded Product with Ticker AUCO2) replicates the performance of its underlying asset – sustainable gold. It is suitable for ESG-minded investors who seek exposure to physical gold – the oldest form of currency and store of value still in use today. The underlying gold is responsibly sourced and certified “Carbon Neutral”. Investors can request physical delivery of minted gold bars during redemption.

This means that Swiss Green Gold ETP is designed to give investors a sustainable, accessible and secure solution to invest in gold.

Historical Performance

Product Details

| Issuer | Helveteq AG |

| Investor Fee | 0.50% p.a. |

| Base Currency | USD |

| Initial Quantity per Security | 1g |

| VALOR | 116757445 |

| ISIN | CH1167574453 |

| SIX Ticker | AUCO2 |

| WKN | A3G5UP |

| Bloomberg | AUCO2 SW |

| Reuters | AUCO2.S |

Service Providers

| Custodian | Raiffeisen |

| Market Maker | Flow Traders |

| Authorized Participants | Flow Traders ISP |

| Administrator | Apex |

| Security Agent | Adexas Rechtsanwälte AG |

Historical Performance

[wpdatachart id=7]

*Chart shows the development of an initial investment amount of $1000.

Product Statistics

[wpdatatable id=44]

SFDR disclosures

Summary

The Helveteq Swiss Green Gold ETP invests in responsibly sourced carbon neutral gold. The refinery of the gold demonstrates many certifications, in particular, the neutralization of the carbon emissions is Carbon Trust certified.

No significant harm to the sustainable investment objective

The product does not invest in companies, sovereigns or real estate and is, as such, not subject to the sustainability indicators defined in Tables 1, 2 and 3 of Annex I of the Commission Delegated Regulation (EU) 2022/1288. Nonetheless, it shall be addressed, that the refinery in scope of this product (MKS Pamp) adresses the issues at hand. MKS PAMP complies with the UN Guiding Principles on Business and Human Rights as required by the LBMA Responsible Gold Guidance V.9 (https://cdn.lbma.org.uk/downloads/Publications/2021/Responsible-Gold-Guidance-Version-9-Final.pdf). MKS PAMP has set for its supply chains ambitious ESG goals, i.e. to reduce negative impacts, including environmental and aim for significant positive societal impact through its commercial and operational activities. As an industry leader regarding sustainable supply chains, MKS PAMP commits to source precious metals in a secure, transparent, traceable, ethically, socially and environmentally responsible way, not tainted by conflict or human right abuses. MKS PAMP factors in a comprehensive range of sustainability indicators, a detailed break-down of which can be found in the Responsible Precious Metals Policy (https://www.mkspamp.com/sites/mksandpamp/files/inline-files/FINAL%20040822_2022%20Group%20Policy_RGG9_0.pdf). Furthermore, MKS PAMP has developed an approach to measure/reduce its Scope 1, 2 and 3 carbon footprint in relation to the Paris Accords and its SBTi approved commitments.

Sustainable investment objective of the financial product

The objective of this product is a reduction in carbon emissions and giving investors access to sustainable gold. The gold is responsibly sourced by a highly accredited refinery and the carbon footprint is assessed and compensated. The process of neutralizing the carbon emissions is certified by Carbon Trust Assurance. This continued effort ensures the attainment of the objective of reducing carbon emissions by channeling capital into carbon neutral assets. This contributes to net-zero undertakings in line with the global warming objectives of the Paris Agreement. MKS PAMP is the first precious metals company in the world to have SBTi approved carbon reduction targets, committing to a 1.5°C emissions reduction in line with the Paris Agreement.

Investment strategy

The product is a tracker on sustainable gold. MKS PAMP Carbon Neutral Gold is being used by means of a physical replication method. The investment strategy is implemented via the collateralization mechanism as described in our Base Prospectus (https://helveteq.com/wp-content/uploads/2022/04/BaseProspectusApril2022.pdf), which is monitored by an independent administrator.

Helveteq Swiss Green Gold ETP is designed to enable investors to gain a carbon neutral, simple and cost-efficient way to access the precious metals market by providing a return equivalent to the movements in the spot price of sustainable gold less the applicable management fee. The ETP provides for easy investor access, tradability, transparency and institutional custody solutions within a robust physically backed structure.

Monitoring of sustainable investment objective

The sustainable investment objective is attained by way of the investment strategy (see above), as the Final Terms of the product state that the minimum amount of sustainable gold underlying the product is set to 95%. The underlying Collateral is monitored daily by an independent administrator. The processes in the relevant refinery are monitored by Carbon Trust Assurance and by means of internal and external control systems and audits, such as the London Bullion Market Association’s Responsible Gold Guidance or the RJC Code of Practices. It is the only refinery in Switzerland to simultaneously hold ISO 9001, ISO 14001, ISO 17025 and ISO 45001 accreditations, certified to ensure compliance with ISO 14021 – 100% Recycled Gold and SA8000 accreditation, which is only accredited to two refineries in the world. Regarding the carbon compensation, PAS 2060, PAS 2050 and GHG Protocol Product Standard (ISO 14067) are complied with. More information can be found here: https://www.mkspamp.com/about-us/credentials

Methodologies

Please refer to the paragraph above. The attainment of the sustainable investment objective is measured by the proportion of Collateral underlying the product, that fulfils the defined criteria for sustainable gold. This proportion is set to a minimum of 95%.

Data sources and processing

To attain the sustainable investment objective of this product, we have used first-hand information of the refinery in scope. The quality of the data is ensured by the numerous accreditations of the refinery and the corresponding monitoring processes, as described above under “Monitoring of sustainable investment objective”. Furthermore, we consider additional data sources that may challenge the quality of the data. No data is being estimated.

Limitations to methodologies and data

The data obtained from third-party data providers or issuers may be incomplete, inaccurate, or unavailable and the assumptions or models on which internal analysis rests may have flaws that render the internal assessment incomplete or inaccurate. As a result, there exists a risk of incorrectly assessing a security, resulting in the incorrect inclusion or exclusion of a security. There is also a risk we may not apply the relevant criteria of the ESG research correctly or that the product could have indirect exposure to entities who do not meet the relevant criteria.

Due Diligence

As an intrinsic part of the investment strategy, no other underlyings apart from sustainable gold are allowed. Therefore, no other potentially harmful securities can enter the portfolio.

The chosen underlying for this tracker security was analysed in the form of internal research and several interviews with the refinery itself.

Engagement policies

Helveteq actively engages with companies that are within our market coverage range in a constructive manner. The outcomes of our engagement efforts are communicated to every employee of the company, enabling them to improve our offering to help companies meet ESG goals. Engagement consists of a constructive dialogue between Helveteq and target companies to discuss how they manage ESG risks and seize business opportunities associated with sustainability challenges. Helveteq mainly carries out value engagement.

Value engagement is a proactive approach focusing on long-term, financially material ESG opportunities and risks that can affect companies’ valuation and ability to create value. The primary objective is to create value for investors by improving sustainability conduct and corporate governance.

Attainment of the sustainable investment objective

No index has been designated to this product. The objective of reducing carbon emissions is being attained in the way described in the paragraphs “Sustainable investment objective of the financial product” and “Monitoring of sustainable investment objective”.