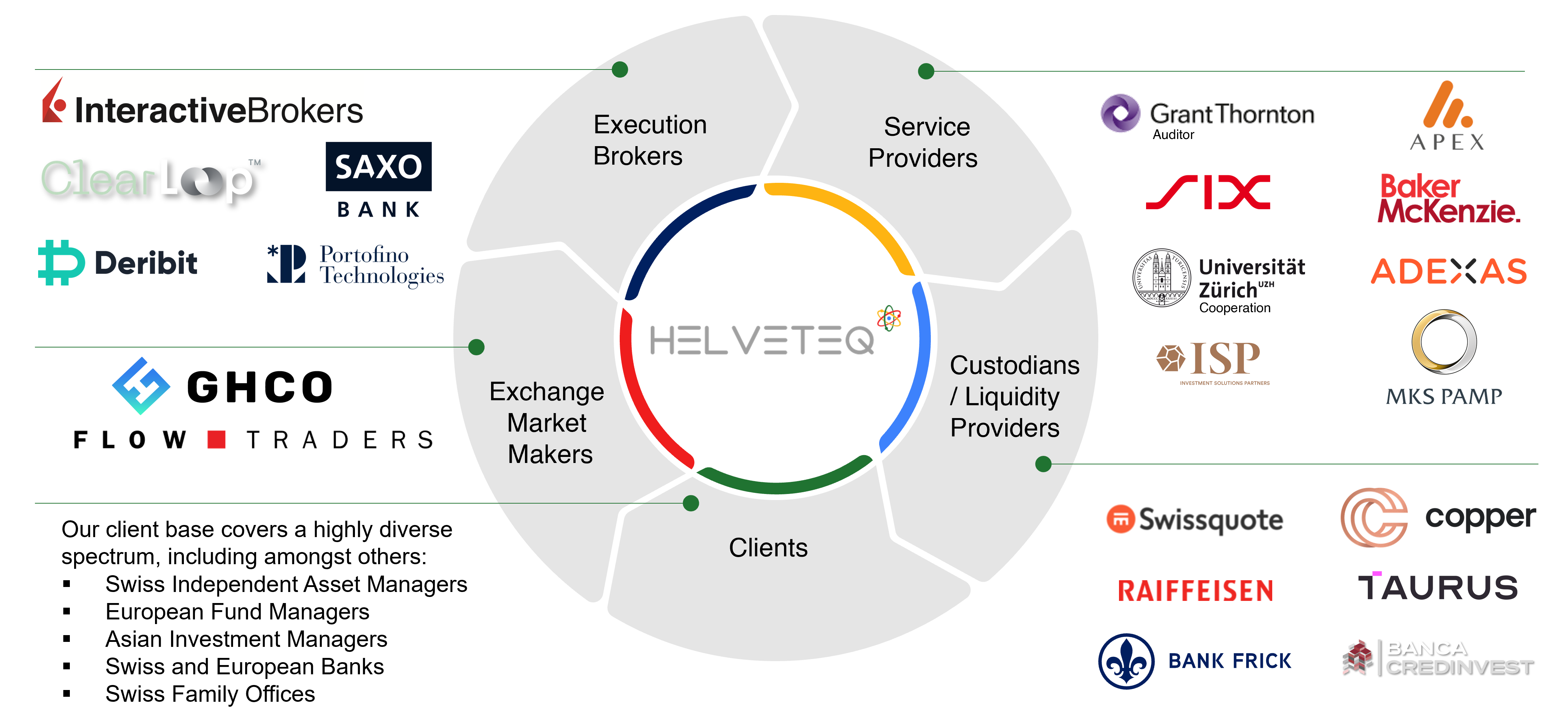

Helveteq Ecosystem - Selection of Partners

White Labeling Solution

We securitize your assets and investment ideas. Helveteq covers a wide range of assets and operates with an outstanding international network. When we securitize your assets or investment ideas, we do so on-exchange or non-listed, but always 100% collateralized and secured. Our products are ESG-transparent.

- ETPs, AMCs, structured products

- Traditional and digital assets

- Traditional assets include equities, bonds, structured products, etc.

- Digital assets cover actively managed portfolios with short derivatives

- Issuance solutions for active and passive strategies

- Single assets, baskets, indices, portfolios

- Mixed underlyings

- Multi-currency

- AMC issuer risk mitigated with 100% collateralization

- No need to set up SPV/PCC

- Faster time to market

- Base prospectus for all products

- Open custodian, multi execution setup

- Pick your own custody institution

- Select your preferred broker

- Highest security standards through segregation of portfolios and independent security agent

- Factsheets summarizing key characteristics

- PRIIP KIDs (Key Infomation Documents)

- Product metadata for Switzerland and EU

- Exclusive “Crypto goes carbon neutral” and “Gold goes carbon neutral”