Helveteq’s approach can be broken down into three objectives:

- We are guided by the SFDR (Sustainable Finance Disclosure Regulation)

- We apply solutions of leading EU associations in structuring sustainable products

- We are consequently aligned with MiFID2 ESG requirements

As of 2 August 2022 with the entry into force of the MiFID suitability assessment process (pursuant to Art. 9 No 9 subpara. 1 MiFID II Delegated Directive (EU) 2017/593), investment firms and advisers must include an additional consideration on whether any existing and new client has sustainability preferences. According to the amended regime (REGULATION (EU) 2021/1253), the client can express sustainability preferences in one or a combination of three ways:

- The percentage of a product’s alignment to the EU Taxonomy

- The percentage of a product’s allocation to sustainable investments as defined in SFDR

- Qualitative and quantitative consideration of principal adverse impacts (PAIs)

In connection with the issuance of products with sustainability features, Helveteq follows the industry’s best practice.

The classification is as follows:

It is worth mentioning that eventually it is up to the client to determine the minimum percentage of Taxonomy alignment, the minimum percentage of sustainable investment and the PAIs.

If the client expresses sustainability preferences in a way that does not match the available product set, we offer our expertise to securitize bespoke solutions.

Please find below the sustainability-related disclosures for Helveteq and all of our products. You can furthermore access the product pages directly to find more information.

| Product | Pre-contractual disclosure | Learn More |

|---|---|---|

| Learn More | ||

| Learn More |

Integration of sustainable risks in investment processes:

Sustainability Risk Policy

Remuneration policy with respect to sustainability risks:

Remuneration Policy

Sustainable investing and transparency:

PAI Statement

Statement on sustainability:

Sustainability Statement

Product Policy (Code of Conduct):

Sustainable Finance Code of Conduct Policy

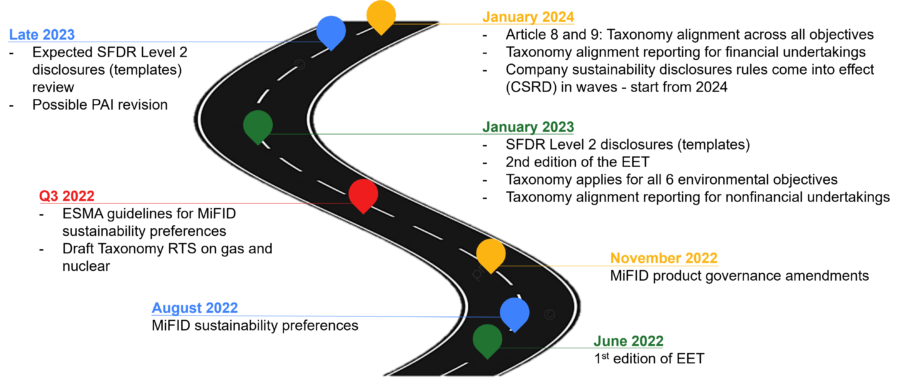

The SFDR entered into force on 10 March 2021. The Regulation requires financial market participants in the EU to provide information to investors with regards to the integration of sustainability risks, the consideration of adverse sustainability impacts, the promotion of environmental or social characteristics, and sustainable investment. The goal of this regulation is to enhance transparency with regards to ESG-related risks and objectives. By creating a solid framework for ESG reporting, the risk of greenwashing shall me minimized. Part of the SFDR are the PAI (principal adverse impacts) on sustainability indicators. The purpose of PAI is to disclose possible negative impacts on sustainability with regards to the investments that are being made. On top of the SFDR, the EU has already set in place the so-called Taxonomy which aims to enhance the ESG transparency even further by urging financial service providers to calculate the percentage of funds that ultimately flow into “sustainable economic activities”.

Bearer debt securities, certificates and structured notes (hereinafter “Products“) are important components of a diversified financial investment, yet these Products are not directly covered by the scope of European legislation. The classification of our Products with sustainability features follows the assignment of product categories to specific sections of the Disclosure Regulation in accordance to the “ESG Target Market Concept” of the German Banking Industry (DK), the German Derivatives Association (DDV) and the German Investment and Asset Management Association (BVI). In particular, as part of the structuring process, Helveteq forms a Sustainable Asset Pool to the extent of the proceeds of a specific Product. This allows any given Product to be assigned the sustainability characteristics of the specific Sustainable Asset Pool allocated to it. Through this approach, the investor’s investment is linked to the financing of an economic activity that has an “ecology” or “sustainability” feature or takes environmental and social issues (through PAI) into account.

For each asset held in the Sustainable Asset Pool, the issuer calculates an SFDR ratio and/or, as soon as the required data is available, the taxonomy ratio. For the taxonomy ratio, either the KPIs reported by the investee companies in accordance with Article 8 of the Taxonomy Regulation or – to the extent permitted by supervisory law – data and/or taxonomy ratios supplied by external data providers can be used. These may relate to the investee company or specific assets. To determine the SFDR ratio, the issuer may use internal and/or publicly available data relating to the respective investee company as well as data and/or SFDR ratios provided by external data providers relating to the respective investee company. The individual SFDR or taxonomy ratios are then used to determine an SFDR or taxonomy ratio for the entire Sustainable Asset Pool as a whole.

A product is allocated to a Sustainable Asset Pool, hence the SFDR or taxonomy ratio of the product corresponds to that of the respective Sustainable Asset Pool. If several Sustainable Asset Pools have been set up, the allocation will be made to the Sustainable Asset Pool with an SFDR or taxonomy ratio corresponding to that specified for the structured product by the issuer.