Key Data

| Issuer | Helveteq AG |

| Base Currency | CHF |

| VALOR | 135709969 |

| ISIN | CH1357099691 |

| Issue Date | 15.07.2024 |

| Maturity | open end |

| Investor Fee | 0.95% p.a. |

| Subscription Fee | 1.00% |

| Nominal Value | 10’000.00 |

| Issue Size | 5’000.00 |

| NAV | 10’526.71 CHF (31.01.26) |

About the Product

Product Description

The certificate provides economic exposure to receivables arising from selected Swiss mortgage loan agreements assigned to the Issuer. Investors are economically exposed to a diversified pool of mortgage loan claims held by the Issuer. This pool of mortgage loan claims is diversified across numerous individual mortgages to limit concentration risk.

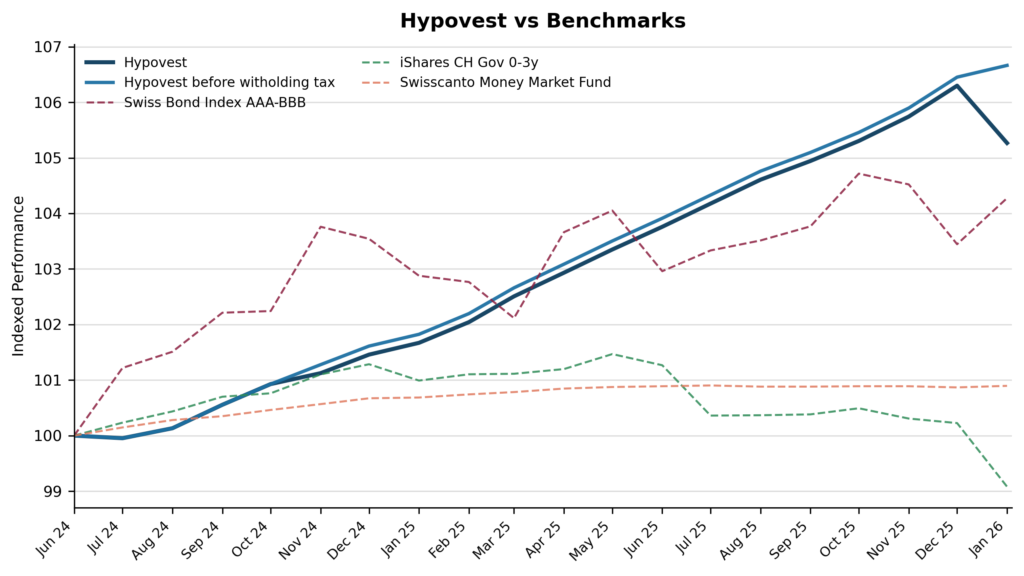

For the calendar year 2025, the product recorded a realised NAV performance of +4.93% before withholding tax (as shown in the performance table). Past performance does not guarantee future results, and returns depend on the performance and recoverability of the underlying loan claims.

Underlying Assets and Eligibility

Exposure is limited to assigned Swiss residential mortgage loan claims secured by subordinated mortgages on existing properties in Switzerland; construction financing is excluded. Eligible loans must be rated A+ to C(Switzerlend scale), have maturities of up to five years, and a maximum LTV of 80%. The portfolio consists solely of assigned receivables and uses no leverage or derivatives. Loans are originated via the Lend.ch platform.

Risk Management Framework

Single-loan exposure is capped in order to limit concentration risk. The loan claim pool is diversified across borrowers, regions, and property types.

Redemption are processed only to the extend sufficient cash is available. If cash is not available, redemption requests are deferred.

Loan performance is monitored on an ongoing basis. A defined recovery and enforcement process applies in the event of arrears or delinquency.

Historical Performance

Monthly NAV Performance Indicators in %

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | ||

| 2026 | before withholding tax | 0.33 | 0.33 | |||||||||||

| 2026 | after withholding tax | -0.97 | -0.97 | |||||||||||

| 2025 | before withholding tax | 0.36 | 0.37 | 0.46 | 0.42 | 0.41 | 0.40 | 0.40 | 0.41 | 0.32 | 0.34 | 0.42 | 0.53 | 4.93 |

| 2025 | after withholding tax | 0.21 | 4.77 |

Service Providers

| Calculation Agent | Helveteq AG |

| Paying Agent | Banca Credinvest SA |

| Originator & Loan Servicer | Switzerlend AG |

| Security Agent | Adexas Rechtsanwälte AG |