Product Description

Swiss Green Gold ETP (Exchange Traded Product with ticker AUCO2) replicates the performance of its underlying asset – sustainably sourced physical gold, subject to the terms and conditions set out in the Final Terms.

The underlying gold is sourced through a carbon-compensation framework, as described in the product documentation. The product provides exposure to physical gold within a fully collateralised ETP structure.

Swiss Green Gold ETP is a bearer debt security and is subject to issuer risk. While the product is structured within a fully collateralised framework, issuer risk cannot be eliminated entirely.

Investors may be able to request physical delivery of minted gold bars during redemption, subject to the applicable terms, conditions and procedures set out in the Final Terms.

Swiss Green Gold ETP is designed to provide a transparent and accessible way to gain exposure to physical gold through a listed security, while integrating sustainability-related considerations as described in the relevant disclosure documents.

Product details are provided for informational purposes only. Please refer to the Base Prospectus and Final Terms for the legally binding terms of the product.

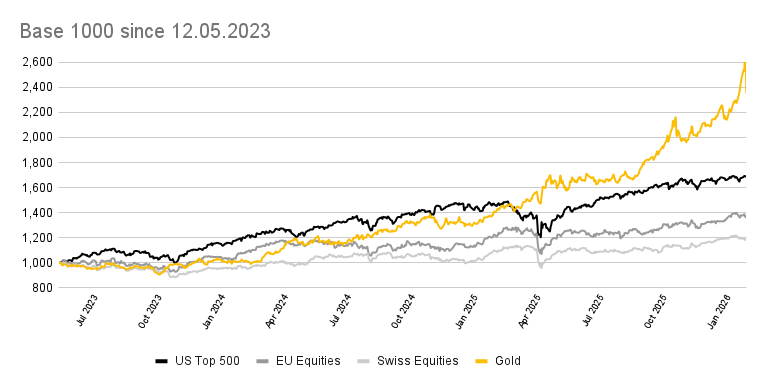

Historical Performance

Product Details

| Issuer | Helveteq AG |

| Investor Fee | 0.50% p.a. (Additional fees may apply at bank or broker level.) |

| Base Currency | USD |

| Initial Quantity per Security | 1g |

| VALOR | 116757445 |

| ISIN | CH1167574453 |

| SIX Ticker | AUCO2 |

| WKN | A3G5UP |

| Bloomberg | AUCO2 SW |

| Reuters | AUCO2.S |

Service Providers

| Calculation Agent | Helveteq AG |

| Market Maker | Flow Traders |

| Authorized Participants | Flow Traders Banca Credinvest SA |

| Custodian | Raiffeisen |

| Security Agent | Adexas Rechtsanwälte AG |

Historical Performance

[wpdatachart id=7]

*Chart shows the development of an initial investment amount of $1000.

Product Statistics

[wpdatatable id=44]

SFDR disclosures

Swiss Green Gold ETP integrates sustainability-related considerations as part of its product structure and disclosures. The product provides exposure to responsibly sourced physical gold, with environmental aspects assessed and addressed through carbon-compensation mechanisms, as described in the product documentation.

The product does not invest in companies, sovereigns or real estate and is therefore not directly subject to certain sustainability indicators applicable to traditional corporate investments. Relevant sustainability-related information is disclosed in accordance with applicable SFDR requirements and made available through the pre-contractual disclosures and product documentation.

The sustainability characteristics of the product are assessed based on information obtained from the underlying refinery and independent third-party certifications. While sustainability-related methodologies and data continue to evolve, Helveteq aims to provide transparent and consistent disclosures in line with current regulatory standards.